Table of Contents

- What are the benefits and drawbacks of upfront payment?

- Pros of paying for a used car upfront

- Cons of paying upfront

- Advantages and disadvantages of financing a car

- Pros of financing a car

- Cons of financing a car

- Factors to consider when deciding between financing vs. cash

- Your financial health

- Your future income potential

- Type of purchase

- Market conditions

Financing vs. cash: What’s the best way to pay for a used car?

A car is one of the biggest purchases a person can make, so exploring different paying options is crucial for making the right decision. Even if you can pay upfront, financing a car can sometimes make better financial sense and vice versa.

So, how do you decide the best way to pay for a used car? Each option brings a set of advantages and considerations, making this choice a deeply personal one.

Let’s take a closer look at financing and cash payments as options for a used car purchase. This will help you make a decision that aligns with your financial goals and preferences.

Looks can be deceiving!

Don't risk your safety – check it with carVertical first.

What are the benefits and drawbacks of upfront payment?

It’s normal and acceptable to pay for a used car in cash or arrange a wire transfer from your bank, and many people prefer this method for various reasons. Some like a more straightforward process, while others want to avoid debt that comes with financing.

Before handing most (or even all) of your savings to a used car seller, learn why paying upfront in full is beneficial and what the potential drawbacks are.

Pros of paying for a used car upfront

Ownership from day one. When you pay for a car in cash or transfer the money to the seller’s bank account, you immediately become the vehicle’s owner. There are no financial obligations or agreements and no lenders, so you get complete control over the car. You can use it as you want or resell it without any restrictions.

- No monthly payments. Paying upfront frees you from monthly payments that also include interest. Without monthly payments, you have more disposable income in your budget, which can reduce financial stress (especially if you have fixed or limited income).

- No interest and a lower total cost of purchase. Since you don’t pay interest when you make an upfront payment, it can help you save a significant amount of money in the long term. Your car’s total cost will be lower than if you decided to finance it.

- Psychological benefit of being debt-free. The state of being debt-free itself can provide a huge psychological advantage. It can lead to reduced stress, increased confidence, and a greater sense of financial security and control. Some people hate owing money and feel anxious to return it as soon as possible, which can affect their overall well-being.

Cons of paying upfront

- Takes time to save. One of the biggest drawbacks of paying for a car in full is how long it takes to save money. You may miss opportunities in a used car market during that time. Moreover, saving up for a car can limit your ability to cover other expenses.

- Missed investment opportunities. Similarly, if you’re saving up to buy a car, you might miss out on potential investment opportunities that could have provided a higher return on your money.

- Limited selection. If you’re paying upfront, you’re limited to the amount of money you’ve saved. This may restrict your options to a narrower range of vehicles and might not be enough to purchase your desired car.

- Paying cash doesn’t build credit. Making a cash purchase doesn’t contribute to your credit history because the credit bureaus do not record the payment. If you’re trying to build or repair credit, taking an auto loan and making timely payments can help you do it.

- Cash transactions leave no record. If you decide to pay for a car in cash and something goes wrong after the purchase, there’s no guarantee that you’ll recover your losses or can prove that you made the payment at all.

- Risk of depleting your savings. Using a large portion of your savings to buy a car can deplete or significantly reduce your emergency fund. This can leave you vulnerable to unexpected expenses like car or household repairs.

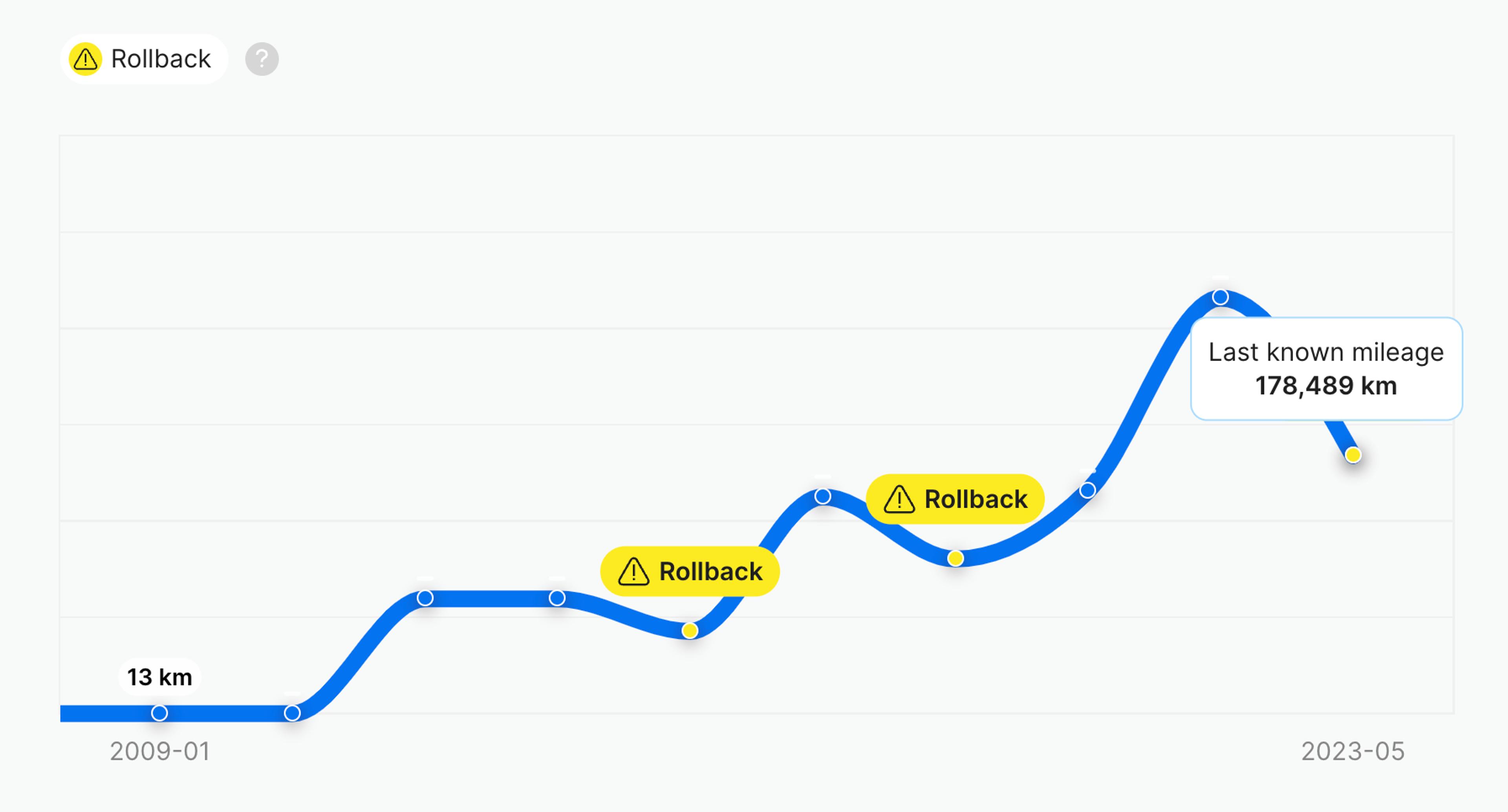

PRO TIP: Before buying any car, check its history. A car that has been severely damaged in the past (and fixed poorly) or has a clocked odometer can result in hefty repair bills in the future. So it’s important to identify the car’s weak spots before hitting the road and consider potential expenses when paying upfront. After all, you’re paying just for the car’s initial cost.

Check your VIN

Avoid costly problems by checking a vehicle's history. Get a report instantly!

Advantages and disadvantages of financing a car

Financing, on the other hand, can be a great option for those who qualify for a good interest rate and want more flexibility when buying a car.

Here are some advantages and things to consider when borrowing money to buy a car.

Pros of financing a car

- Spread out the cost. If you don’t have the full amount to purchase the car upfront, financing allows you to spread the cost of the vehicle over a longer period of time.

- Broader selection of cars. Financing allows you to choose from a wider variety of cars and can bring newer and better cars into your price range. It means that you’re more likely to find a car that perfectly fits your needs or the one you’ve been dreaming of for a while.

- Preserving cash flow. When you finance a car, you don’t need to pay the entire price upfront, meaning you can keep the money you’ve saved for other investments, opportunities, or emergencies.

- Potential tax advantages. In some cases, the interest paid on a car loan may be tax-deductible. For example, in the US, those who are self-employed or own a business and use a car for business purposes may claim a tax deduction for car loan interest. This depends on your location and individual circumstances, so do your research in advance or consult a professional.

- Building credit. Regular, on-time payments on your car loan can help you build a positive credit history. This can be beneficial for future loans or credit applications.

- Flexibility. When financing, you can choose the length of your loan term, different down payment options, and sometimes even payment frequency. Moreover, if your financial situation improves, you generally have the option to make extra payments and pay off the loan early.

Cons of financing a car

- Paying interest. Financing a car means that you’ll be paying back the loan every month, typically with interest. The total interest paid over the life of the loan can significantly increase the overall cost of the vehicle.

- Stretching your monthly budget. Monthly payments can take up a sizeable amount of your disposable income, putting a strain on your budget, especially if your financial situation changes.

- You don’t really own your car. Technically, the lender owns your car until you fully pay the loan. You can’t modify or sell it, and if you fail to pay off the loan, the lender might be able to take the car back.

- Possibility of accumulating debt. If you don’t approach financing with careful consideration of your financial situation and a clear understanding of the loan’s long-term impact on your budget, you may pave the way for unexpected financial challenges in the future.

- Potential for negative impact on credit. If you’re unable to make your car loan payments on time, it can harm your credit score, as late/missed payments are reported to credit bureaus.

- Depreciation costs. After a vehicle is finally paid off, naturally, its value will be lower than when you first purchased it. Besides, if you have a high interest rate, you can end up owing more than your car’s worth.

Factors to consider when deciding between financing vs. cash

Deciding how to pay for a used car is an important financial decision that can shape your next several years and affect your overall well-being. Below are the factors that you have to take into consideration when making this choice.

However, if you’re having second thoughts, consulting a financial advisor is highly recommended.

Your financial health

Your current financial situation is critical when deciding between financing and paying upfront for a car. To minimize potential risks, consider your monthly income and expenses, emergency funds, and existing debt, if any.

Firstly, evaluate if you have enough disposable income after meeting your essential expenses to cover a car loan if you choose to finance. In other words, think if you’d be comfortable making monthly payments that can be expensive and living with the money left.

As for the emergency fund, it’s recommended to have 3-6 months’ worth of living expenses saved up for unexpected scenarios. If you don’t have it, dedicating a large portion of the money you’ve saved to a car purchase may be risky.

Finally, if you have other high interest debts, you may want to wait until you pay those off instead of making another large purchase.

Your future income potential

Long-term financial planning is crucial, especially when purchasing something as big as a car. Therefore, before making any decisions, consider the potential for your future income growth.

For instance, evaluate how stable your current job and industry are. If there’s uncertainty or potential for negative change, you might want to be more cautious about taking a long-term car loan.

On the other hand, maybe there is a possibility of potential promotion or career change? This can impact your ability to pay the loan comfortably.

Type of purchase

Whether to finance or pay upfront can also be determined by the nature of the purchase itself. Often, this can even bring some other options to the table, like considering new vs. used vehicles, or leasing.

Compared to used cars, new cars typically have lower interest rates for financing. If you’re considering financing, make sure to weigh the pros and cons of new and used cars, so that you can make a decision that better aligns with your goals.

Leasing, on the other hand, can be an alternative to both financing and upfront payments. It provides a middle ground, allowing you to use the car for a set period without committing to full ownership.

Market conditions

Finally, think about overall economic and market conditions, as they can also impact the consequences of your decision.

For example:

- Keep an eye on current interest rates. If they are low, it may be a good time to consider financing.

- Consider the depreciation of the car. If you’re financing, this could affect your decision, as it may influence the resale value of a car.

- Assess the broader economic landscape. If you anticipate significant inflation or economic uncertainty, you might want to hold onto your cash and consider financing.

Choosing between financing vs. cash is a decision you don’t need to rush, especially when there’s no one-size-fits-all answer. Therefore, consider your specific circumstances and preferences to make a personalized choice, or consult a financial advisor who can provide insights based on your unique financial situation.

FAQ

If I have the cash when buying a car, is it always better to just pay outright?

Not necessarily – while paying cash can have its advantages, other factors must be considered. Evaluate different options, like financing or leasing, your current financial situation, future income potential, and overall economic and market conditions to make the right decision.

Is paying cash better for negotiating deals?

Paying cash can indeed give you more negotiating power, for example, if the seller wants to sell a car faster or aims for immediate payment.

Can I pay off my car loan early?

In most cases, you can pay off your car loan early. However, some lenders may have prepayment penalties or restrictions so it’s important to check the terms and conditions of your loan agreement.